Wealth Planning & Client Management Platform

35% Faster Financial Plan Delivery

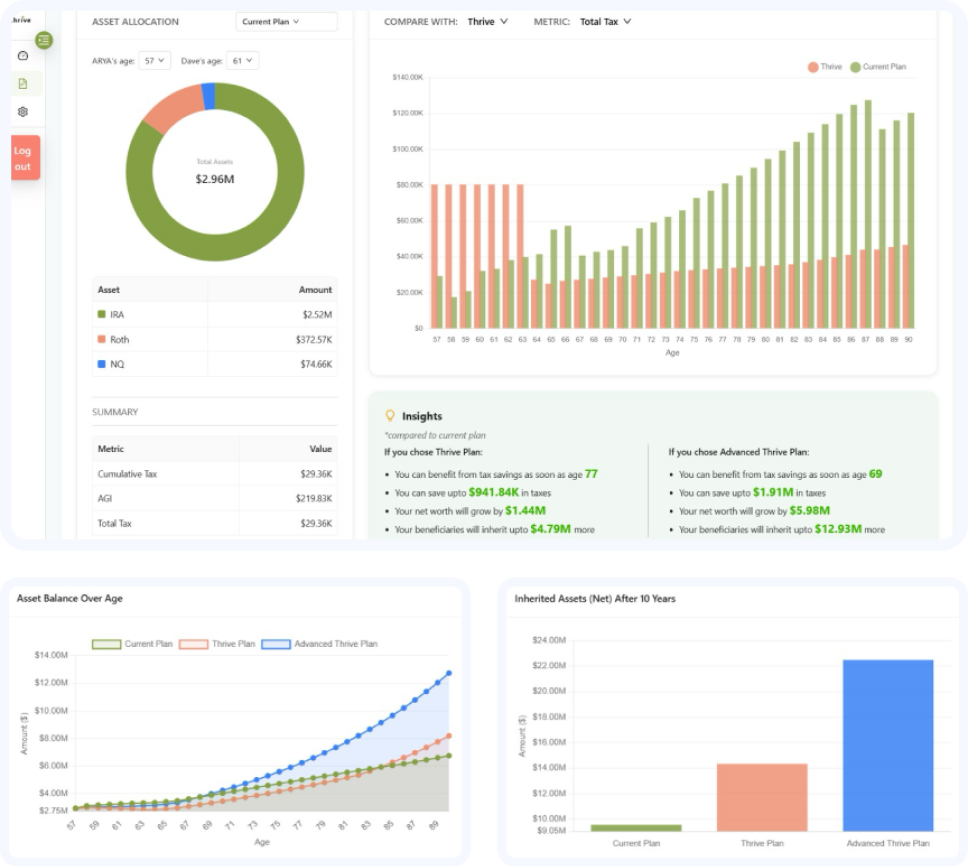

A wealth planning and financial management platform designed for a boutique wealth management firm to improve operational efficiency and client servicing at scale. The solution automates long-term financial projections across account types, centralizes client data and plans, and extracts financial information from documents to reduce manual effort.

Key Features

Comprehensive Financial Projections:

The platform projects future balances across all of a client's retirement and investment accounts, providing a clear and unified financial outlook.

Centralized Client & Plan Management:

All client information, assumptions, and financial plans are managed in one system, simplifying operations and improving data consistency.

Automated Financial Data Extraction:

Relevant data is automatically extracted from financial documents such as tax returns, reducing manual input and improving data accuracy.

Intelligent Scenario Comparison:

Easily compare existing and proposed investment structures to generate and present multiple scenarios quickly.

Results and Impact:

35% Reduction in Plan Turnaround Time:

Automated projections and centralized workflows significantly accelerated financial plan delivery.

30% Reduction in Operational Costs:

Lower manual effort and reduced rework decreased the cost of producing and managing financial plans.

Increase in Advisor Productivity:

Advisors were able to manage more client plans simultaneously without increasing team size.

Improved Client Experience & Engagement:

Faster plan delivery and clearer projections strengthened client confidence and decision-making.

Similar Solutions We Can Build:

Wealth Management Analytics Dashboard:

An advanced dashboard providing real-time insights into client portfolios and long-term projections.

Intelligent Document Processing for Financial Firms:

An AI-driven system that extracts, validates, and structures data from financial documents such as tax returns and statements.

AI-Powered Client Onboarding & KYC Platform:

A solution that automates client onboarding, document collection, and verification to reduce administrative effort.